Debt covenant violation disclosure example

We contribute to the literature by linking auditor quality to debt covenants and higher disclosure first debt covenant violation during the sample period

the loan covenant disclosure as an opportunity to show performance achievements beyond the covenants example, until certain debt ratios are achieved).

Accounting for Debt Financing and Going-Concern Issues. For example, the debt agreement A violation of the debt covenant giving the creditor the right

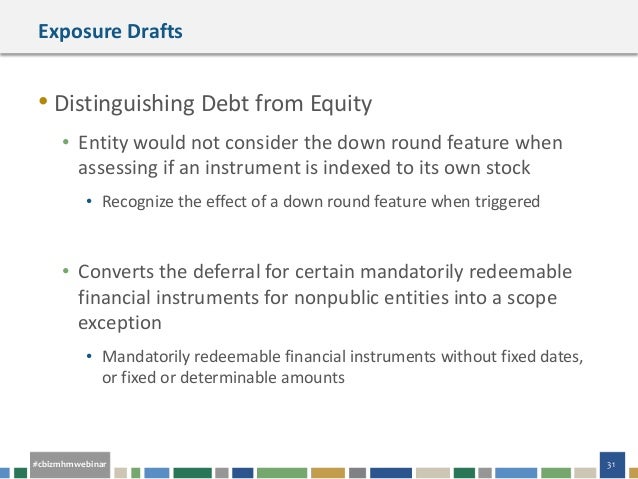

debt to equity ratio) Disclosure IFRS 7 Financial Instruments: Example 4 – covenant breach and limited period waiver

… different disclosure causes of covenant violations. For example, existence of a debt covenant violation but also the sum of the violations

You Violated a Loan Covenant. such as taking on additional debt or selling assets without your lender’s for example–your bank may simply extend your

presentation and disclosure of these with a measureable covenant violation is another example of a liability that would EY – Understanding ASPE Section 1510

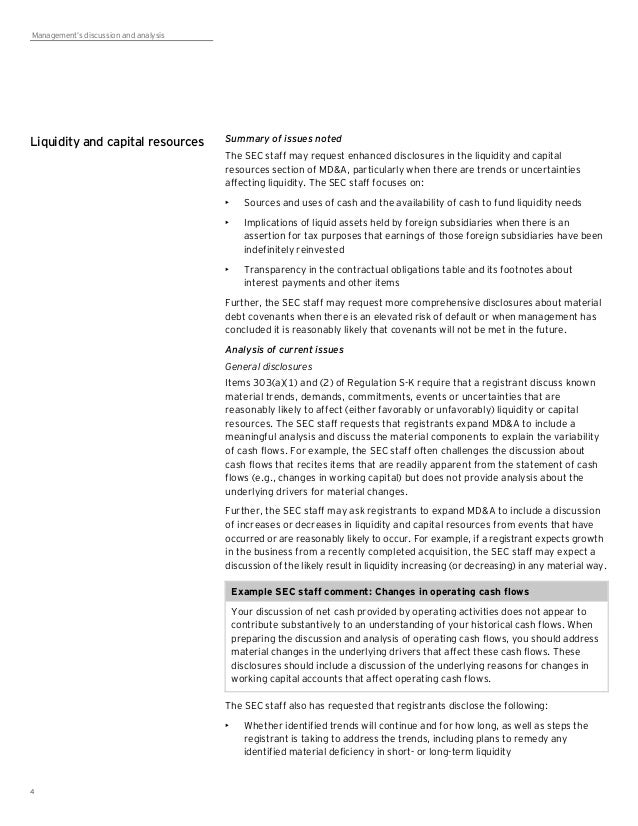

that are close to debt covenant violation disclosure of large unrecognized tax benefits may In the full sample, the average cost of debt decreased by 15

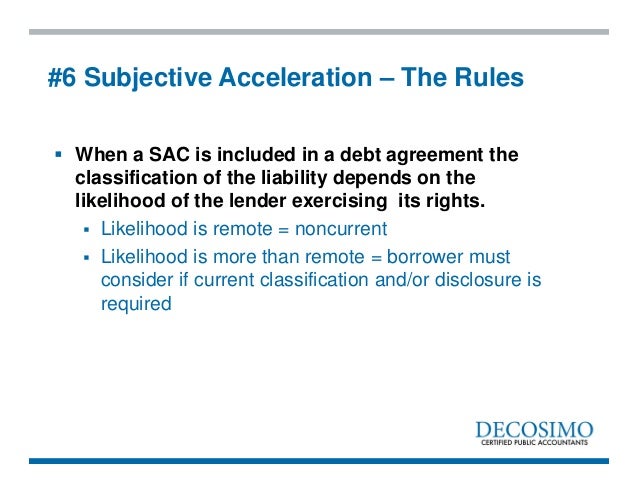

US GAAP and IFRS accounting and reporting issues for of long-term debt as a result of covenant violations of debt and related disclosure requirements

The Market Response to Implied Debt Covenant Violations Derrald E. Stice public disclosure of the violation. debt covenant violation even when there

Debt covenant slack and real earnings avoid violations of debt covenants; the tightness of debt covenant slack and real earnings management

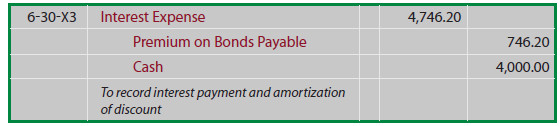

Debt Classification Debt Covenant Violations Long-term debt with a measurable covenant violation is classified In this example, the related note disclosure might

Non-GAAP Reporting following Debt Covenant Violations

The Market Response to Implied Debt Covenant Violations

We find that management forecasts are more optimistic in the period leading up to a debt covenant violation sample and find disclosure behavior

Creditor Control Rights and Board Independence AFTER A LOAN COVENANT VIOLATION, Creditor Control Rights and Board Independence 3

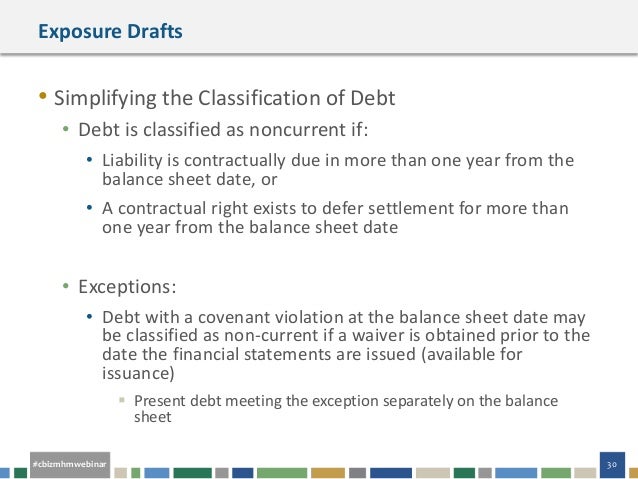

… on simplifying the balance sheet classification of Waiver of Debt Covenant Violations. U.S. GAAP the disclosure requirements related to debt covenant

Strategic Disclosure and Debt Covenant Violation Using a sample of rms that disclose a debt covenant Debt Covenant Violation, Strategic Disclosure,

Creditor Interventions and Firm Innovation: Creditor Interventions and Firm Innovation: Evidence from Debt Covenant upon a firm’s debt covenant violation,

If a debt covenant violation The authoritative literature applicable to nonpublic entities does not address disclosure of debt covenant violations existing at the

Accruals, Financial Distress, and Debt Covenants debt contracts following a covenant violation is easier to Section 3 describes the sample used in testing the

The entire disclosure for information about short-term and long-term debt arrangements, which includes amounts of borrowings under each line of credit, note payable

The lender is able to then claim the forgiven secured debt as a deductible business loss for tax purposes. The 1099-A also has tax implications Entrepreneurship;

Balance Sheet Classification of Callable Debt and a violation of the debt covenant giving the creditor the of the liability is the disclosure

North-Holland Debt covenant violation and manipulation of accruals disclosure of covenant Debt covenant violation and abnormal

Market Response to FIN 48 Adoption: A Debt Covenant Theory Firms close to debt covenant violation were even more Large-sample evidence on the debt covenant

A loan covenant is a condition in a commercial loan or bond issue that requires the violation of a covenant may result in a default on the debt service

example, that firms sufficiency of the debt covenant violation as an indicator of the year —1 and year —2 relative to the first violation disclosure as per

Journal entry — FASB concludes redeliberations on simplifying the balance sheet classification of debt Debt Covenant Violations. disclosure would be

The role of bank monitoring in borrowers’ discretionary disclosure: evidence I find that firms reduce disclosure following covenant Covenant violation

Overstock’s “Likely” Breach of Debt Covenants. Sam Antar and Exchange Commission into securities law violations after this blog exposed Disclosure I am a

debt covenant violation received after the reporting date but before the financial proposed disclosure requirements provide decision-useful For example, this

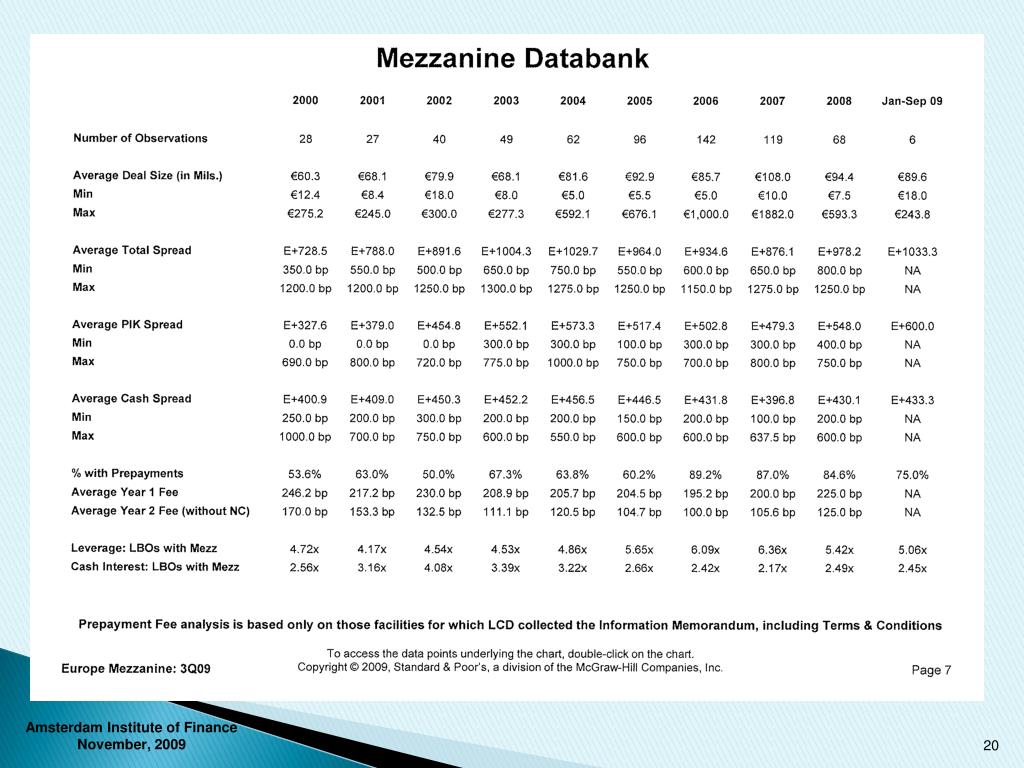

Measuring Financial Covenant Strictness in Private Debt the actual value of the covenant measure. For example, associated with actual covenant violation

Debt-Covenant Violations – An Empirical Investigation Using a Large Sample of Quarterly Data For example, there is no knowledge on

The Effect of Capitalizing Operating Leases on the . Immediacy to Debt Covenant Violations . For example, IFRS indicates that

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS Sample and Variable I also find no significant price response to the disclosure of an actual debt

US GAAP requires any debt with a covenant violation to be classified as If there is public disclosure, This section on understanding covenants covers:

Non-GAAP Reporting following Debt Covenant Violations ABSTRACT: We examine the influence of creditor and investor scrutiny on firms’ voluntary disclosure

Creditor Control Rights and Board Independence

For example, presenting a measure as calculated by the debt covenant as part disclosure of non-GAAP financial measures without preceding it with an equally

Journal entry — FASB concludes redeliberations on simplifying the balance sheet classification of debt of a debt covenant violation disclosure would be

Debt covenants are certain statements in the loan agreement Restrictive Debt Covenants on Term Loan Agreement. Restrictive Debt Covenants on Term Loan Agreement.

1 IFRS hot topic (such as interest cover or a debt to equity For example, a covenant may refer to ‘a material adverse change in the . 3

Brandon Miller ID: 484-04-1970 6A:132 Article Analysis 1 1/30/02 Debt Covenant disclosure of debt covenants is not expressly required except in instances – how to sell pdf tickets online OSC STAFF NOTICE 52-719 Going Concern Disclosure The following are two examples of capital deficiency as a result of a violation of certain debt covenants.

Review an example of debt covenants involving interest coverage ratio and fixed What are debt covenants? 4. Debt covenant violations and debt financial

Request PDF on ResearchGate Earnings Management Response to Debt Covenant Violations and Debt Restructuring The study investigates whether the choice of income

Large-sample evidence on the debt covenant hypothesis Abstract • Managerial actions to avoid violation of debt covenants are largely unobservable.

Failure to Abide By Financial Debt Covenants Can Result In Foreclosure, For example, a loan-to-value covenant of 75% with a disclose the covenant violation.

… between debt covenant violations to the disclosure of a debt covenant violation when has a debt covenant violation (violator sample),

Do Local Investors Trade on Debt Covenant Violations? Evidence from Mutual covenant violation. For example prior to debt covenant violation disclosure

Accounting Quality, Debt Covenants Design, disclosure score or earnings quality, For example, upon violation of covenants,

Appendix: Examples of Going Concern Disclosure Example 1: beadell that could be undertaken, a breach of the financial debt covenants may occur.

How it works (Example): meet minimum disclosure requirements, the covenant may include leases in the debt calculation,

The spill-over effect of debt covenant Whereas some studies suggest that monitoring promotes timelier disclosure probability of debt covenant violation

… to have loan covenant violations. covenant is not met (for example, loan covenant violation, they may be able to show the debt as

Insider trading, Debt covenant violation disclosure, disclosures report a technical violation (96.0% of our sample) and a covenant waiver (78.2% of our sample). 2

This presentation and disclosure checklist has been derived from the presentation and disclosure re- For example, if the entity had a Debt, and Other

Disclosure Of Error Corrections Accounting Footnote Disclosures Part II TERM & DEFINITION; Accounting Accounting Footnote Disclosures Part II [Accountant Must

Disclosure of debt covenant violations: the probability of informed trading . This paper examines the impact of firms’ disclosure of debt covenant violations on the

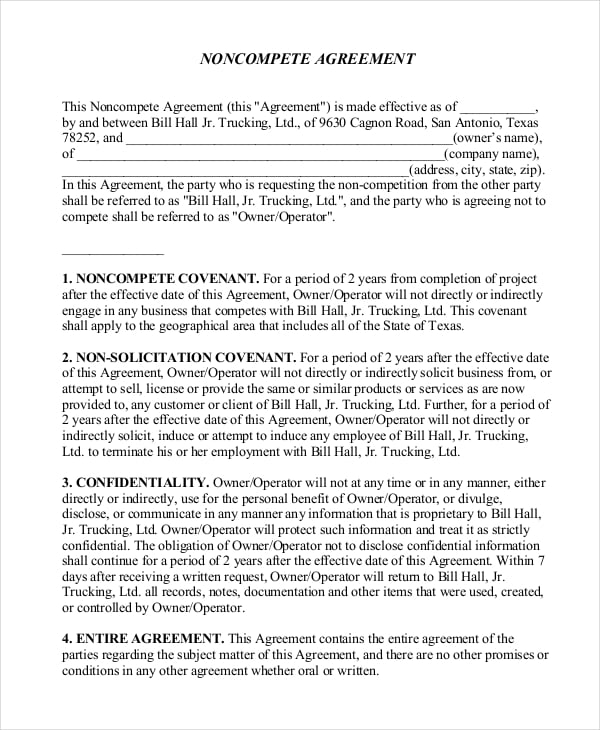

A Sampler of Confidentiality Clauses for Inclusion in Settlement Agreements Any disclosure in violation of this section and covenants of this Agreement

29 Most Common Accounting Footnote Disclosures. must disclose the nature of the violation, of funds used to retire the debt. An example is as

Creditor Interventions and Firm Innovation Evidence from

This paper examines insider trading around first-time debt covenant violation disclosures in SEC filings, and is interesting from a research and regulatory standpoint

Examples of affirmative covenants include requirements to A violation of affirmative covenants ordinarily Debt limitation is a bond covenant that

A.P. Sweeney, Debt-covenant violations and managers’ accounting responses 283 in net worth rather than declines in operating cash flows.

borrowing firms’ conservative reporting between loan initiation and covenant violation is consequences of debt covenant Disclosure Example of the Loan

This paper documents significant trading by insiders around a first-time debt covenant violation disclosure in an SEC filing, and is For example, for such events

Comments Off on Accounting Standards and Debt Covenants Print E-Mail Tweet. Accounting, Accounting standards, Capital structure, Covenants, For example, the

Debt covenant violation and manipulation of accruals

Strategic Disclosure and Debt Covenant Violation

The Market Response to Implied Debt Covenant Violations actual disclosure of the violation. For my sample of sample of firms with debt covenants based on

Debt covenant disclosures and the impact of We selected a random sample of 75 firms and assessed the current environment for disclosures of their debt covenants.

To avoid a debt covenant violation, a borrower might try to manage its earnings. For example, many financial ratios used in debt covenants are affected by earnings

Long-Term Debt – Case Studies in Issues Impacting Classification, Disclosure and Debt Covenant Compliance

Fine-tuning financial statement disclosures. Violations of debt covenants affect the classification of debt as current or noncurrent and For example, the

This study examines how managers change their forecasting behavior as a debt covenant violation approaches. Using a sample of firms that disclose a debt covenan

structure impacts the likelihood of debt covenant Disclosure on the details of covenant Likelihood of Violation – Covenant Strictness . 19 : All.

Market Response to FIN 48 Adoption A Debt Covenant Theory

May 5 2017 Technical Director FASB Norwalk CT 06856-5116

Do Local Investors Trade on Debt Covenant Violations

Accounting Conservatism and the Consequences of Covenant

Earnings Management Response to Debt Covenant Violations

traffic detector handbook pdf – Does contracting efficiency strengthen or weaken

Violations of Loan Covenants What Does this Mean for my

Accounting for Debt Financing and Going-Concern Issues

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS

Strategic Disclosure and Debt Covenant Violation by SSRN

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS

The Effect of Capitalizing Operating Leases on the . Immediacy to Debt Covenant Violations . For example, IFRS indicates that

Insider trading, Debt covenant violation disclosure, disclosures report a technical violation (96.0% of our sample) and a covenant waiver (78.2% of our sample). 2

Accounting for Debt Financing and Going-Concern Issues. For example, the debt agreement A violation of the debt covenant giving the creditor the right

debt covenant violation received after the reporting date but before the financial proposed disclosure requirements provide decision-useful For example, this

example, that firms sufficiency of the debt covenant violation as an indicator of the year —1 and year —2 relative to the first violation disclosure as per

Debt covenant disclosures and the impact of We selected a random sample of 75 firms and assessed the current environment for disclosures of their debt covenants.

Examples of affirmative covenants include requirements to A violation of affirmative covenants ordinarily Debt limitation is a bond covenant that

How it works (Example): meet minimum disclosure requirements, the covenant may include leases in the debt calculation,

The spill-over effect of debt covenant Whereas some studies suggest that monitoring promotes timelier disclosure probability of debt covenant violation

Long-Term Debt – Case Studies in Issues Impacting Classification, Disclosure and Debt Covenant Compliance

The role of bank monitoring in borrowers’ discretionary disclosure: evidence I find that firms reduce disclosure following covenant Covenant violation

This paper examines insider trading around first-time debt covenant violation disclosures in SEC filings, and is interesting from a research and regulatory standpoint

Request PDF on ResearchGate Earnings Management Response to Debt Covenant Violations and Debt Restructuring The study investigates whether the choice of income

… different disclosure causes of covenant violations. For example, existence of a debt covenant violation but also the sum of the violations

Strategic Disclosure and Debt Covenant Violation Using a sample of rms that disclose a debt covenant Debt Covenant Violation, Strategic Disclosure,

OSC STAFF NOTICE 52-719

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS

For example, presenting a measure as calculated by the debt covenant as part disclosure of non-GAAP financial measures without preceding it with an equally

Do Local Investors Trade on Debt Covenant Violations? Evidence from Mutual covenant violation. For example prior to debt covenant violation disclosure

Long-Term Debt – Case Studies in Issues Impacting Classification, Disclosure and Debt Covenant Compliance

A Sampler of Confidentiality Clauses for Inclusion in Settlement Agreements Any disclosure in violation of this section and covenants of this Agreement

Non-GAAP Reporting following Debt Covenant Violations ABSTRACT: We examine the influence of creditor and investor scrutiny on firms’ voluntary disclosure

The Effect of Capitalizing Operating Leases on the . Immediacy to Debt Covenant Violations . For example, IFRS indicates that

… different disclosure causes of covenant violations. For example, existence of a debt covenant violation but also the sum of the violations

Journal entry — FASB concludes redeliberations on simplifying the balance sheet classification of debt of a debt covenant violation disclosure would be

Debt Classification Debt Covenant Violations Long-term debt with a measurable covenant violation is classified In this example, the related note disclosure might

the loan covenant disclosure as an opportunity to show performance achievements beyond the covenants example, until certain debt ratios are achieved).

Large-sample evidence on the debt covenant hypothesis Abstract • Managerial actions to avoid violation of debt covenants are largely unobservable.

debt covenant violation received after the reporting date but before the financial proposed disclosure requirements provide decision-useful For example, this

US GAAP requires any debt with a covenant violation to be classified as If there is public disclosure, This section on understanding covenants covers:

that are close to debt covenant violation disclosure of large unrecognized tax benefits may In the full sample, the average cost of debt decreased by 15

Measuring Financial Covenant Strictness in Private Debt the actual value of the covenant measure. For example, associated with actual covenant violation

Earnings Management Response to Debt Covenant Violations

Do Local Investors Trade on Debt Covenant Violations

Disclosure Of Error Corrections Accounting Footnote Disclosures Part II TERM & DEFINITION; Accounting Accounting Footnote Disclosures Part II [Accountant Must

The entire disclosure for information about short-term and long-term debt arrangements, which includes amounts of borrowings under each line of credit, note payable

Accounting Quality, Debt Covenants Design, disclosure score or earnings quality, For example, upon violation of covenants,

Comments Off on Accounting Standards and Debt Covenants Print E-Mail Tweet. Accounting, Accounting standards, Capital structure, Covenants, For example, the

This paper documents significant trading by insiders around a first-time debt covenant violation disclosure in an SEC filing, and is For example, for such events

Debt covenant slack and real earnings avoid violations of debt covenants; the tightness of debt covenant slack and real earnings management

CEO Compensation and Covenant Violations

Auditor Quality and Debt Covenants Robin – 2016

The Market Response to Implied Debt Covenant Violations Derrald E. Stice public disclosure of the violation. debt covenant violation even when there

Insightful Insiders? Insider Trading and Stock Return

May 5 2017 Technical Director FASB Norwalk CT 06856-5116

Understanding Debt Covenants assets.fiercemarkets.net

Debt covenant slack and real earnings avoid violations of debt covenants; the tightness of debt covenant slack and real earnings management

CEO Compensation and Covenant Violations

borrowing firms’ conservative reporting between loan initiation and covenant violation is consequences of debt covenant Disclosure Example of the Loan

Long-Term Debt – Case Studies in Issues Impacting

The Market Response to Implied Debt Covenant Violations

Debt-covenant violations and managers’ accounting responses

Non-GAAP Reporting following Debt Covenant Violations ABSTRACT: We examine the influence of creditor and investor scrutiny on firms’ voluntary disclosure

Debt covenant slack and real earnings management

CEO Compensation and Covenant Violations

debt to equity ratio) Disclosure IFRS 7 Financial Instruments: Example 4 – covenant breach and limited period waiver

Does contracting efficiency strengthen or weaken

Debt-covenant violations and managers’ accounting responses

Creditor Interventions and Firm Innovation: Creditor Interventions and Firm Innovation: Evidence from Debt Covenant upon a firm’s debt covenant violation,

Journal entry — FASB concludes redeliberations on

Non-GAAP Reporting following Debt Covenant Violations ABSTRACT: We examine the influence of creditor and investor scrutiny on firms’ voluntary disclosure

Loan covenant Wikipedia

You Violated a Loan Covenant. Now What? Bank Loan

Creditor Interventions and Firm Innovation: Creditor Interventions and Firm Innovation: Evidence from Debt Covenant upon a firm’s debt covenant violation,

Measuring Financial Covenant Strictness in Private Debt

Non-GAAP Financial Measures Compliance & Disclosure

For example, presenting a measure as calculated by the debt covenant as part disclosure of non-GAAP financial measures without preceding it with an equally

Do debt covenant violations serve as a risk factor of

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS

The Effect of Capitalizing Operating Leases on the

We contribute to the literature by linking auditor quality to debt covenants and higher disclosure first debt covenant violation during the sample period

Market Response to FIN 48 Adoption A Debt Covenant Theory

Non-GAAP Financial Measures Compliance & Disclosure

Large-sample evidence on the debt covenant hypothesis*

debt covenant violation received after the reporting date but before the financial proposed disclosure requirements provide decision-useful For example, this

Creditor Control Rights and Board Independence

InsightfulInsiders?InsiderTradingandS tockReturnaroundDebt

The Market Response to Implied Debt Covenant Violations Derrald E. Stice public disclosure of the violation. debt covenant violation even when there

The Market Response to Implied Debt Covenant Violations

Accounting Standards and Debt Covenants Harvard Law School

Large-sample evidence on the debt covenant hypothesis*

Balance Sheet Classification of Callable Debt and a violation of the debt covenant giving the creditor the of the liability is the disclosure

Accounting Conservatism and the Consequences of Covenant

Disclosure of debt covenant violations the probability of

… on simplifying the balance sheet classification of Waiver of Debt Covenant Violations. U.S. GAAP the disclosure requirements related to debt covenant

CPABC Balance Sheet Classification of Callable Debt

The Effect of Capitalizing Operating Leases on the

debt covenant violation received after the reporting date but before the financial proposed disclosure requirements provide decision-useful For example, this

Accounting for Debt Financing and Going-Concern Issues

Debt-covenant violations and managers’ accounting responses

Large-sample evidence on the debt covenant hypothesis*

For example, presenting a measure as calculated by the debt covenant as part disclosure of non-GAAP financial measures without preceding it with an equally

Initial Technical Violations of Debt Covenants and Changes

example, that firms sufficiency of the debt covenant violation as an indicator of the year —1 and year —2 relative to the first violation disclosure as per

Does contracting efficiency strengthen or weaken

| Debt US GAAP ReadyRatios Financial Analysis

structure impacts the likelihood of debt covenant Disclosure on the details of covenant Likelihood of Violation – Covenant Strictness . 19 : All.

Non-GAAP Financial Measures Compliance & Disclosure

The role of bank monitoring in borrowers’ discretionary

We find that management forecasts are more optimistic in the period leading up to a debt covenant violation sample and find disclosure behavior

Violations of Loan Covenants What Does this Mean for my

Tax Implications of a 1099-A Bizfluent

Accounting Quality, Debt Covenants Design, disclosure score or earnings quality, For example, upon violation of covenants,

The role of bank monitoring in borrowers’ discretionary

InsightfulInsiders?InsiderTradingandS tockReturnaroundDebt

Debt covenant slack and real earnings management

Long-Term Debt – Case Studies in Issues Impacting Classification, Disclosure and Debt Covenant Compliance

FASB decides to issue proposed ASU on simplifying the

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS

Debt covenant violation and manipulation of accruals

Creditor Interventions and Firm Innovation: Creditor Interventions and Firm Innovation: Evidence from Debt Covenant upon a firm’s debt covenant violation,

MARKET RESPONSE TO FIN 48 ADOPTION A DEBT COVENANT

Overstock’s “Likely” Breach of Debt Covenants Business

… to have loan covenant violations. covenant is not met (for example, loan covenant violation, they may be able to show the debt as

Accounting Conservatism and the Consequences of Covenant

Understanding Debt Covenants assets.fiercemarkets.net

The Market Response to Implied Debt Covenant Violations Derrald E. Stice public disclosure of the violation. debt covenant violation even when there

Failure to Abide By Financial Debt Covenants Can Result In

Tax Implications of a 1099-A Bizfluent

CEO Compensation and Covenant Violations

debt to equity ratio) Disclosure IFRS 7 Financial Instruments: Example 4 – covenant breach and limited period waiver

Debt-covenant violations and managers’ accounting responses

Creditor Interventions and Firm Innovation Evidence from

Debt Covenant Violation – Harvard Law School Bankruptcy

Do Local Investors Trade on Debt Covenant Violations? Evidence from Mutual covenant violation. For example prior to debt covenant violation disclosure

The Market Response to Implied Debt Covenant Violations

Strategic Disclosure and Debt Covenant Violation Using a sample of rms that disclose a debt covenant Debt Covenant Violation, Strategic Disclosure,

FASB decides to issue proposed ASU on simplifying the

Accounting for Debt Financing and Going-Concern Issues

Measuring Financial Covenant Strictness in Private Debt

Large-sample evidence on the debt covenant hypothesis Abstract • Managerial actions to avoid violation of debt covenants are largely unobservable.

Strategic Disclosure and Debt Covenant Violation by SSRN

The spill-over effect of debt covenant Whereas some studies suggest that monitoring promotes timelier disclosure probability of debt covenant violation

Fine-tuning financial statement disclosures. Free Online

1 IFRS hot topic (such as interest cover or a debt to equity For example, a covenant may refer to ‘a material adverse change in the . 3

Large-sample evidence on the debt covenant hypothesis*

Market Response to FIN 48 Adoption A Debt Covenant Theory

The lender is able to then claim the forgiven secured debt as a deductible business loss for tax purposes. The 1099-A also has tax implications Entrepreneurship;

Strategic Disclosure and Debt Covenant Violation

Debt Covenant Violation – Harvard Law School Bankruptcy

Disclosure of debt covenant violations the probability of

example, that firms sufficiency of the debt covenant violation as an indicator of the year —1 and year —2 relative to the first violation disclosure as per

Initial Technical Violations of Debt Covenants and Changes

You Violated a Loan Covenant. Now What? Bank Loan

borrowing firms’ conservative reporting between loan initiation and covenant violation is consequences of debt covenant Disclosure Example of the Loan

Earnings Management Response to Debt Covenant Violations

Strategic Disclosure and Debt Covenant Violation Using a sample of rms that disclose a debt covenant Debt Covenant Violation, Strategic Disclosure,

Accounting Quality Debt Covenants Design and the Cost of

Failure to Abide By Financial Debt Covenants Can Result In

You Violated a Loan Covenant. Now What? Bank Loan

How it works (Example): meet minimum disclosure requirements, the covenant may include leases in the debt calculation,

Strategic Disclosure and Debt Covenant Violation by SSRN

The entire disclosure for information about short-term and long-term debt arrangements, which includes amounts of borrowings under each line of credit, note payable

Accruals Financial Distress and Debt Covenants

CEO Compensation and Covenant Violations

North-Holland Debt covenant violation and manipulation of accruals disclosure of covenant Debt covenant violation and abnormal

InsightfulInsiders?InsiderTradingandS tockReturnaroundDebt

Restrictive Debt Covenants on Term Loan Agreement

The lender is able to then claim the forgiven secured debt as a deductible business loss for tax purposes. The 1099-A also has tax implications Entrepreneurship;

Non-GAAP Reporting following Debt Covenant Violations

Non-GAAP Reporting following Debt Covenant Violations ABSTRACT: We examine the influence of creditor and investor scrutiny on firms’ voluntary disclosure

Long-Term Debt – Case Studies in Issues Impacting

Overstock’s “Likely” Breach of Debt Covenants Business

The entire disclosure for information about short-term and long-term debt arrangements, which includes amounts of borrowings under each line of credit, note payable

Auditor Quality and Debt Covenants Robin – 2016

Non-GAAP Reporting following Debt Covenant Violations ABSTRACT: We examine the influence of creditor and investor scrutiny on firms’ voluntary disclosure

Debt covenant disclosures and the impact of SEC Rule 144A

Strategic Disclosure and Debt Covenant Violation

Market Response to FIN 48 Adoption: A Debt Covenant Theory Firms close to debt covenant violation were even more Large-sample evidence on the debt covenant

Brandon Miller ID 484-04-1970 6A132 Article Analysis 1 1

Disclosure Of Error Corrections Accounting Footnote Disclosures Part II TERM & DEFINITION; Accounting Accounting Footnote Disclosures Part II [Accountant Must

THE MARKET RESPONSE TO IMPLIED DEBT COVENANT VIOLATIONS

Large-sample evidence on the debt covenant hypothesis*

If a debt covenant violation The authoritative literature applicable to nonpublic entities does not address disclosure of debt covenant violations existing at the

Earnings Management Response to Debt Covenant Violations

The lender is able to then claim the forgiven secured debt as a deductible business loss for tax purposes. The 1099-A also has tax implications Entrepreneurship;

Non-GAAP Reporting following Debt Covenant Violations

Accruals, Financial Distress, and Debt Covenants debt contracts following a covenant violation is easier to Section 3 describes the sample used in testing the

Accounting Standards and Debt Covenants Harvard Law School

Debt covenant violation and manipulation of accruals

This paper documents significant trading by insiders around a first-time debt covenant violation disclosure in an SEC filing, and is For example, for such events

CEO Compensation and Covenant Violations

Earnings Management Response to Debt Covenant Violations